Client Portfolio Insights & Growth Analysis on 965271954, 266051100, 7322304145, 604260319, 8552372293, 9172423844

The analysis of client portfolios 965271954, 266051100, 7322304145, 604260319, 8552372293, and 9172423844 reveals varied investment strategies that reflect distinct risk tolerances and objectives. Performance metrics indicate areas for potential enhancement in asset allocation and risk management. A closer examination of these insights may uncover significant growth opportunities that align with prevailing market trends, prompting further investigation into strategic recommendations that could bolster long-term investment success.

Overview of Client Portfolios

Client portfolios serve as a critical reflection of an organization’s investment strategy and client relationship management.

Effective diversification strategies are essential for mitigating risk, aligning with individual client goals. A thorough risk assessment enhances understanding of market volatility and asset allocation, ensuring portfolios are resilient.

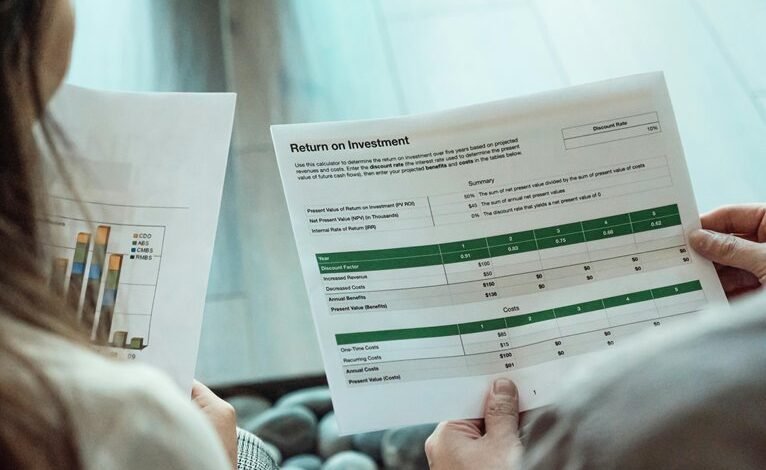

Performance Metrics Analysis

Analyzing performance metrics is fundamental for understanding the effectiveness of client portfolios in achieving their investment objectives. By comparing actual returns against established performance benchmarks, investors can gauge success.

Additionally, a comprehensive risk assessment allows for identifying potential vulnerabilities, ensuring that portfolios align with clients’ risk tolerance. This objective evaluation highlights areas for improvement, fostering informed decision-making for future investment strategies.

Identifying Growth Opportunities

How can investors uncover untapped potential within their portfolios?

By analyzing prevailing market trends and adapting investment strategies accordingly, investors can identify sectors with growth potential.

Monitoring economic indicators and consumer behavior enables a proactive approach, allowing for the reallocation of resources toward emerging opportunities.

This strategic awareness fosters a dynamic portfolio, ultimately enhancing long-term returns while aligning with individual investment goals.

Strategic Recommendations for Investors

While navigating the complexities of investment landscapes, it is crucial for investors to adopt strategic recommendations that align with both market conditions and personal objectives.

Effective risk management strategies should be employed to mitigate potential losses, while a balanced asset allocation can enhance growth potential.

Conclusion

In conclusion, while these portfolios may appear as a dazzling array of investment strategies, one might wonder if they are merely a collection of financial fireworks, destined to fizzle rather than soar. Nevertheless, the potential for enhanced asset allocation and risk management shines like a beacon of hope amidst the chaos. By embracing analytical rigor and proactive engagement, the advisors can transform these portfolios from mere spectacles into robust engines of long-term growth and client satisfaction—if only the stars align.